What We Do

Succession Planning

Succession Isn’t Just a Business Decision — It’s Personal

If you’re the founder or owner of a small or medium-sized enterprise, you know what it took to build your business — the decisions, the risks, the relationships, and the relentless work.

Now you’re thinking about what’s next.

Whether you’re looking to exit, pass the reins to the next generation, or simply reduce your day-to-day role, the transition doesn’t have to feel uncertain or overwhelming.

With the right plan, you can:

- Protect what you’ve built

- Empower the next generation of leadership

- Step back with clarity, confidence, and peace of mind

We help small and medium-sized business owners create succession plans that protect their legacy and secure their future.

Strategic. Empathetic. Structured.

We work with founders who are asking:

- “Can I step away without the business falling apart?”

- “Is my team or my family ready to lead?”

- “How do I secure my financial future without risking the company?”

- “How do I make this transition without causing conflict?”

- “What happens if I do nothing?”

If any of these sound familiar, you’re not alone. Succession is one of the most sensitive and complex phases in a business — and one of the most important.

Our Succession Services

We provide hands-on support across every phase of transition:

-

Succession Planning for SME & Family Businesses

Design a clear, structured leadership transition — whether it’s to a family member, internal talent, or external successor.

-

Exit Strategy & M&A Readiness

Position your business for a partial or full exit, with the right structure, valuation, and team in place. We support you through negotiation prep, due diligence readiness, and investor alignment.

-

Business Transition Coaching

Support for both founders and successors in clarifying roles, managing mindset shifts, and building mutual trust.

-

Founder & Family Conflict Mediation

Neutral, experienced facilitation to navigate sensitive conversations around ownership, leadership, or legacy.

-

Board-Level Advisory & Governance

Independent guidance during the transition and beyond. We help stabilize leadership, build governance structures, and provide continuity as you step back.

-

Strategic Roadmapping

Align your business vision, leadership plan, and long-term financial goals — even during uncertain times.

Succession is about more than documents or deals.

It’s about people, timing, and protecting what matters most.

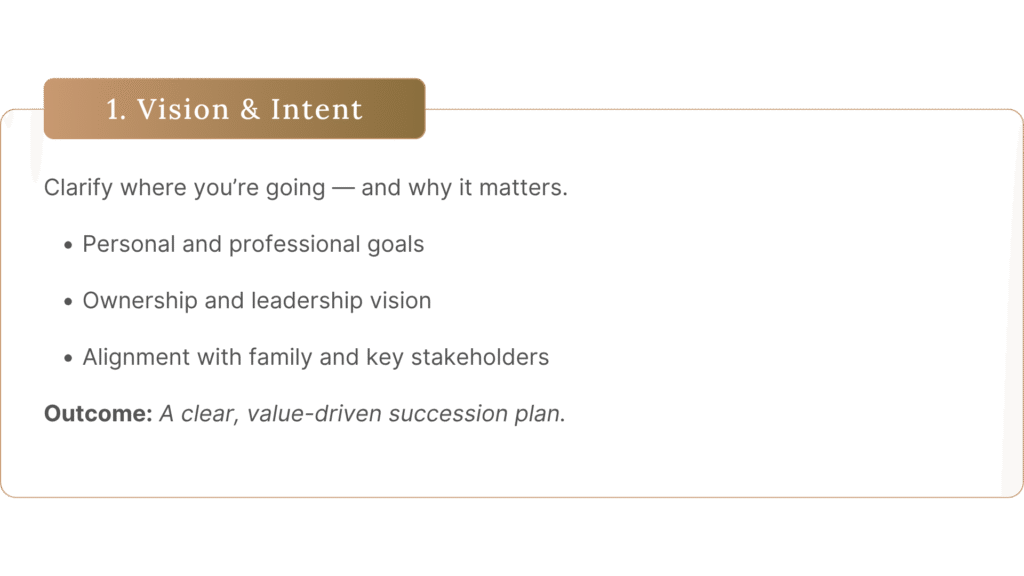

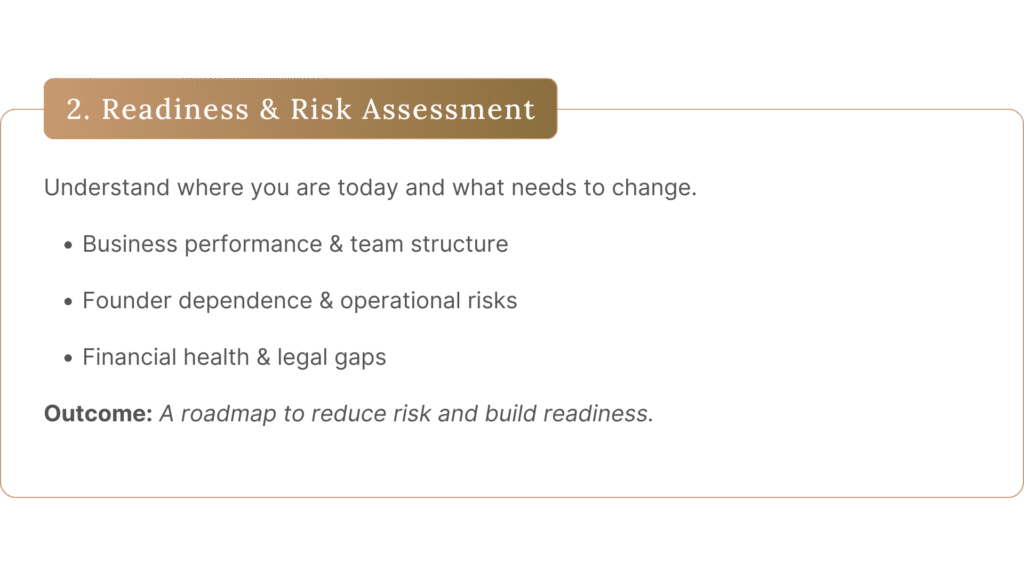

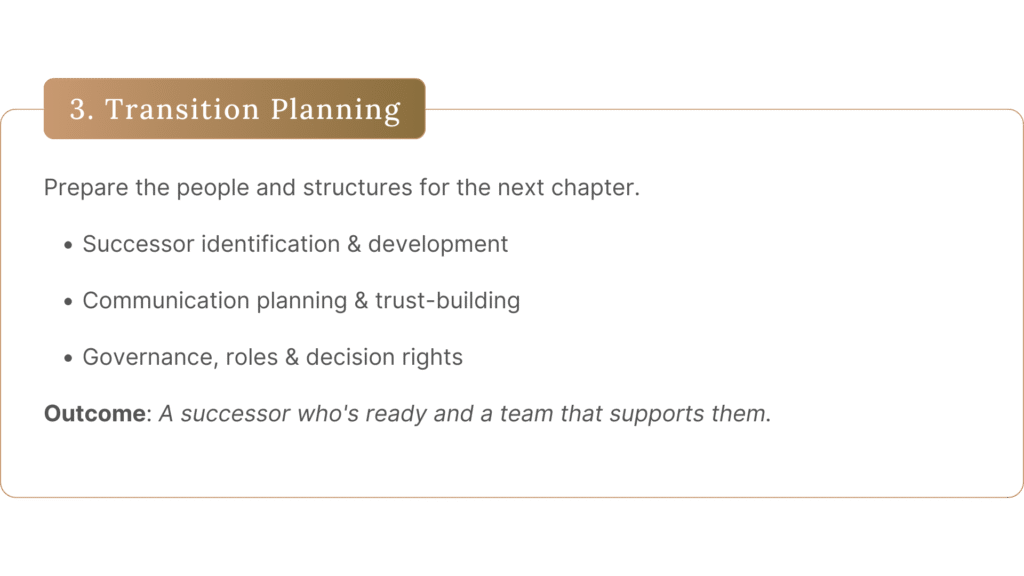

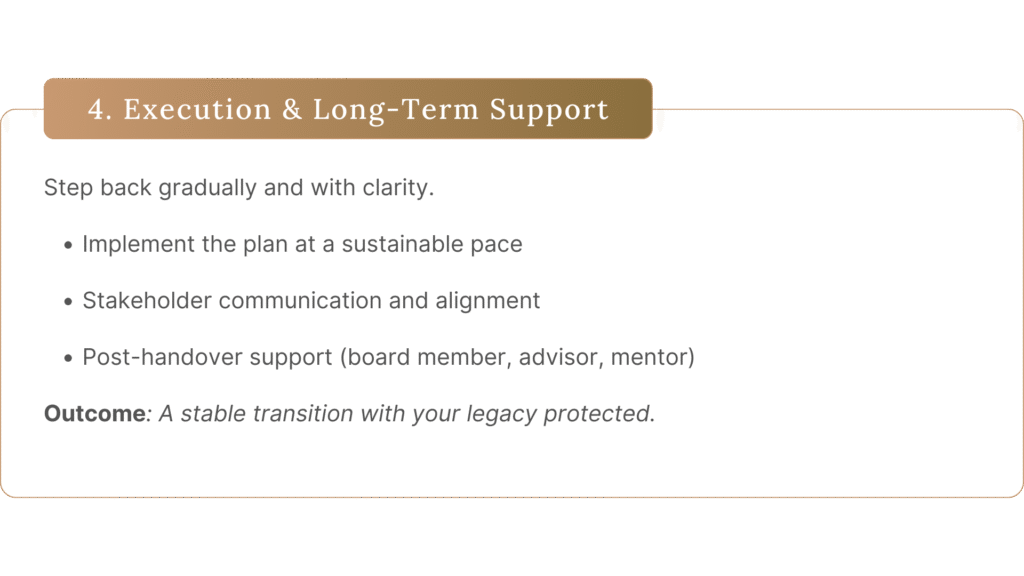

Our 4-Phase Succession Process

Succession isn’t a single event. It’s a process — and one that requires structure and perspective.

We guide business owners through four distinct phases:

What Clients Say

“I thought succession meant stepping away completely. This process showed me how to stay involved without holding the team back.”

– Founder, Energy Services Business

“Our family was stuck. Too many opinions, too much emotion. Having an outside advisor brought clarity and peace.”

– CEO, 2nd Gen Manufacturing Firm

“We went from vague ideas to a real plan in three months. I’m confident about the future and so is my team.”

– Owner, Professional Services Company

Why Choose an Independent Succession Advisor?

There are plenty of consultants out there. But succession isn’t just another project. It’s personal. It’s emotional. And it’s often complex.

We’re not a large consulting firm — and we see that as an advantage.

- Real-World Insight - Decades of senior business leadership, board roles, and real transition experience - not just theory.

- One Point of Contact – No junior teams or rotating faces. You work directly with a seasoned advisor who knows your business and earns your trust.

- Tailored Plans – We start with your values and goals - not with a template. Every plan is grounded in your reality.

- Discreet and Professional – We work quietly and in confidence, without disrupting daily operations or raising alarm.

- Built for SME owners – We know how owner-led businesses work - the pressures, the relationships, the risks, and the pride.

- Legacy-focused – We’re not here to upsell. We’re here to help you protect the business and relationships you’ve built.

After years of guiding SME and family business owners through succession, we’ve learned that what you don’t do is just as important as what you do.

Here’s what we firmly avoid — and why it benefits you:

- We do not apply generic frameworks.

We tailor each succession plan to your unique goals, culture, and people. - We do not overcharge or oversell.

You get senior-level, hands-on support without inflated fees or unnecessary scope. - We do not hand you off to junior consultants.

You work directly with experienced advisors who understand ownership. - We do not overwhelm you with complexity.

We keep it simple, strategic, and focused on practical progress. - We do not treat succession as a transaction.

We treat it with the care, empathy, and discretion it deserves. - We do not focus on paperwork over people.

We support the human side of the transition as much as the technical side.

Let’s Talk Succession — On Your Terms

Whether you’re five years out or already facing tough decisions, we’ll meet you where you are. This is a partnership, not a pitch.

Meet Matthias Kramer

As an independent advisor, I work with founders and entrepreneurs who are starting to think about what comes next: growing the business, stepping back, selling, or preparing the next generation to lead. My role is to guide you through the transition so that your legacy is protected and your business can thrive beyond you.

With experience spanning energy, automotive, professional services, and insurance, I’ve had the privilege of advising founders, families, and leadership teams across sectors. I also serve on boards, where I help shape high-impact decisions around governance, growth, and continuity – always with a focus on protecting the fouinder’s legacy and the company’s long-term value.

Here’s how I typically help SME owners:

- Clarifying goals for succession, sale, or growth

- Succession planning (family or non-family handovers)

- Supporting M&A preparation and buyer/investor readiness

- Leadership evaluation and transition coaching

- Independent board-level input on continuity and governance

My approach is personal, practical, and discreet. Every founder and every business are different – but the goal is always the same: to move forward with confidence, protect what you’ve built, and prepare for what’s next.

If you’re starting to think about succession, stepping back, or simply preparing your business for the future – I’d be glad to talk.

Frequently Asked Questions

Ideally, 3–5 years before you plan to step back, but even starting 6 months out can make a meaningful difference. Early planning gives you more flexibility and fewer regrets.

That’s more common than you think. We help assess internal talent, explore external options, and build a plan that works for your business, even if that means preparing for a sale.

No. We work with privately held, founder-led, and multi-owner SMEs, whether you’re passing the baton to a family member, trusted employee, or external buyer.

Succession doesn’t mean giving up everything overnight. We help you design a gradual, structured transition that lets you step back without stepping out, keeping your influence and stability in place.

With care and neutrality. We’ve guided many business families through high-stakes decisions by facilitating calm, structured conversations without taking sides.

Yes. We coach successors through the transition process from role clarity to leadership development to ensure they’re prepared and supported.

No, we are not transaction-driven. While we support exit strategies and M&A readiness when appropriate, our core focus is on what’s right for you, whether that’s transition, retention, or a hybrid path.

Yes. Succession often touches legal, tax, HR, and governance issues. We regularly collaborate with mandated advisors or bring in trusted specialists from our network when needed. You stay in control. We ensure everything stays aligned, coordinated, and focused on your goals.

Completely. Succession planning is sensitive, especially in small or family-run businesses. We operate confidentially and with full discretion.

A 30–45 minute confidential discovery call where we explore your goals, challenges, and whether we’re the right partner. No pitch, just a grounded conversation.

Disclaimer

The consultants (B&P Partners) featured here operate as independent service providers. Brandt & Partners assumes no responsibility or liability for the accuracy, completeness, or quality of the content displayed, nor for any actions or outcomes resulting from services provided independently by these consultants.